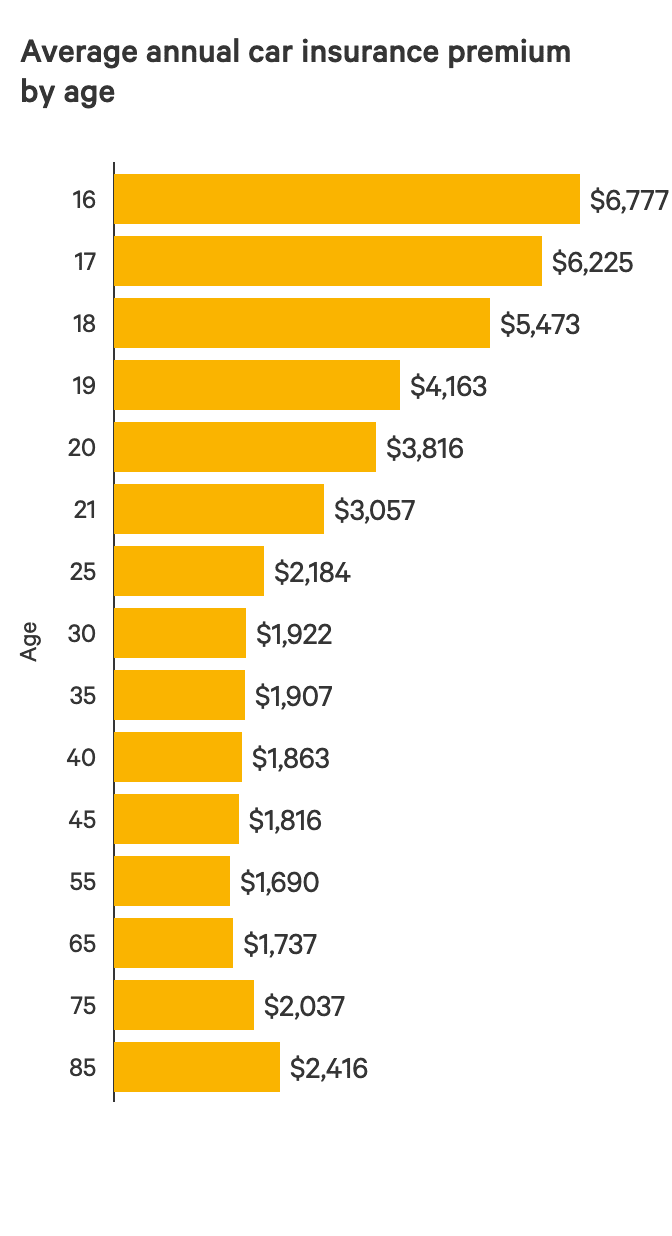

Many students and young drivers will find that car insurance for young and first time drivers, is expensive compared to other drivers. Normally the drivers between the age of 17-21 years will need to pay a hefty amount for the regular insurance. The heavy pricing of the insurance also tends some users to avoid driving and using alternatives. But Why is younger driver insurance so expensive? Do read this article to know why younger motorists pay more?

Why is First Time Driver Insurance Is Expensive?

As we know insurance is all about calculated risk and the insurance also depends on the sort of factors you chose for. The prices of the insurance also depend on these factors but above all the company also calculates how likely a customer can make a claim. The companies also have research and data to determine different rates for different groups of drivers.

Unfortunately, the statistics show that younger drivers behind have a lack of experience behind the wheel and that’s the reason they are more likely to meet an accident as compared to adults. And this is the primary reason why young drivers pay a much higher premium for their insurance. No matter you are a safe driver but statistics show that there is a good chance that you will meet an accident.

Are Young Drivers Really Bad Drivers?

These stats don’t really apply to every Young Motorist, but every one of us is affected by some statistics in some way. And we also can’t ignore the fact that drivers aged between 17 and 24 are more likely to have an accident, and more likely to be killed or get injured in the accidents.

According to the researchers, One in five young drivers crashes their car within a period of the first six months of driving. The same data also shows that 25% of drivers crash their cars within two years of passing the driving test. This all supports the idea that young drivers involve more risk therefore they have to pay more because the company knows they’ll have to pay out for a claim.

Ways To Reduce Car Insurance For Young Drivers

Don’t Drive Without An Insurance

The first thing, if you think you will save money without choosing the insurance, you are wrong. By chance, you will get involved in an accident and you don’t have car insurance this could become bigger than you can think of. In such a case, you will not only face trouble with laws but also hefty repair bills, and the medical bills could become the problem. However, if you have insurance this could get easier.

Improve Driving Skills and Get It Certified.

One thing you can definitely do is try to improve your driving skills and also join some sort of defensive driving course. The classes can be done online or by classroom practices and join with some reputed institute. This can save up to 10% on your insurance premium by using the proof of completion of the course.

Lower The Premium For Saftey Features On Your Car

In simple words make sure that your agent or insurance company adds a discount for the safety features on your car. Safety features like Multiple Airbags, Child lock, Anti Lock Braking systems, and Anti Theft Devices such as alarms can work for lowering the premium.

More Reads: Best Car Insurance In India | Top 5 Car Insurance Company…

Evolution of Koenigsegg | 1996 to 2021 | Part-2

Car Insurance Everything You Need To Know | Types, Importance, Pros…